Oil and Gas News: US sees largest supply surge in history

US to dominate oil and gas markets after largest supply surge in history

The U.S. will be a dominant force in global oil and gas markets for many years to come as the shale boom becomes the biggest supply surge in history, the International Energy Agency (IEA) predicted.

By 2025, the growth in American oil production will equal that achieved by Saudi Arabia at the height of its expansion, and increases in natural gas will surpass those of the former Soviet Union, the agency said in its annual World Energy Outlook. The boom will turn the U.S., still among the biggest oil importers, into a net exporter of fossil fuels.

"The United States will be the undisputed leader of global oil and gas markets for decades to come," IEA Executive Director Fatih Birol said. "There’s big growth coming from shale oil, and as such there’ll be a big difference between the U.S. and other producers."

The agency raised estimates for the amount of shale oil that can be technically recovered by about 30 percent to 105 billion barrels. Forecasts for shale oil output in 2025 were bolstered by 34 percent to 9 million barrels a day. While oil prices have recovered to a two-year high above $60 a barrel, they are still about half the level traded earlier this decade, as the global market struggles to absorb the scale of the U.S. bonanza. It hastaken the Organization of Petroleum Exporting Countries and Russia almost 11 months of production cuts to clear up some of the oversupply.

Reflecting the expected flood of supply, the agency cut its forecasts for oil prices to $83 a barrel for 2025 from $101 previously, and to $111 for 2040 from $125 before. Lower prices are helping to support oil demand, and the IEA raised its projections for global consumption through to 2035, despite the growing popularity of electric vehicles. The world will use just over 100 million barrels of oil a day by 2025.

Graphic courtesy of EIA

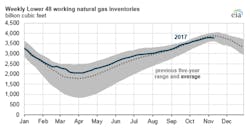

Natural gas inventories end October just below the previous five-year average

Working natural gas in storage in the lower 48 states as of Oct. 31 totaled 3,784 billion cubic feet (Bcf), as interpolated from EIA’s Weekly Natural Gas Storage Report data. Natural gas storage levels typically increase from April through October, although net injections sometimes occur in November. Inventories at the end of October 2017 were 2 percent lower than the previous five-year end-of-October average and 5 percent lower than the record-setting end-of-October level of 3,977 Bcf last year. Natural gas storage is used to balance out seasonal fluctuations in demand. Natural gas demand is highest in the winter months, when residential and commercial demand for natural gas for space heating increases. Natural gas consumption in the power sector is highest in summer months, when overall electricity demand is relatively high for cooling.

Graphic courtesy of EIA

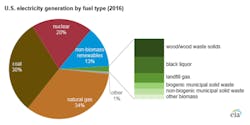

Biomass and waste fuels generated 2 percent of total US electricity in 2016

Biomass and waste fuels generated 71.4 billion kilowatt hours of electricity in 2016, or 2 percent of total generation in the U.S., according to the EIA’s recently released annual electric power data. Biomass fuels are defined as all non-fossil, carbon-based (biogenic) energy sources. Waste fuels are defined as all other non-biogenic wastes. Wood solids accounted for nearly one-third the electricity generated from biomass and waste. Most wood solids come from one of three sources: logging and mill residues; wood, paper, and furniture manufacturing; and discarded large timber products, such as railway ties, utility poles, and marine pilings. Aside from non-biogenic municipal waste, the largest non-biogenic waste fuel is tire-derived fuel. Tire-derived fuel has one of the highest relative heat contents of any generating fuel. Tire-derived fuel provided less than 2 percent of biomass-generated electricity in 2016.

Graphic courtesy of EIA

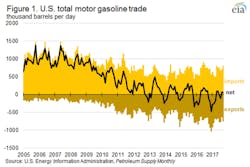

US continues trend toward exporting more gasoline than it imports

Despite record high gasoline consumption, the U.S. is on pace to export more gasoline than it imports for the second year in a row. Changes in regional markets, increased demand for exports, and high refinery runs are once again leading to the U.S. to be a net exporter in 2017. U.S. gasoline imports and exports are highly seasonal. The U.S. has typically been a net importer of gasoline in spring and summer months, when domestic consumption increases, and a net exporter in winter months, when demand is lower. However, for every month between April and August, the U.S. set either record low net imports or record high net exports. Almost year-round net gasoline exports is a major change for U.S. gasoline markets, which is the result of one long-term trend and two more recent trends.