Oil and Gas News: Refined coal growing; 2018 oil market to be more balanced

US LNG exports increase as new facilities come online

In August 2017, total U.S. natural gas liquefaction capacity in the lower 48 states increased to 2.8 billion cubic feet per day (Bcf/d) following the completion of the fourth liquefaction unit at the Sabine Pass liquefied natural gas (LNG) terminal in Louisiana. With increasing liquefaction capacity and utilization, U.S. LNG exports averaged 1.9 Bcf/d, and capacity utilization averaged 80 percent this year, based on data through November. Exports from Sabine Pass began to increase in September 2017 as Train 4 ramped up to full production—reaching 2.7 Bcf/d in November—with an overall capacity utilization rate of 96 percent across four trains. Utilization at Sabine Pass is projected to remain well above 90 percent in winter 2017–2018 as a result of expected strong natural gas winter demand and high spot LNG prices in Asia and Europe.

EPIC NGL pipeline project is first of several new Permian infrastructure projects

EPIC Y Grade Pipeline LP began construction of the EPIC NGL (natural gas liquids) Pipeline on Nov. 14, 2017, with expected completion in early 2019. The 650-mile pipeline will begin in southeastern New Mexico, have several receipt points in both the Delaware and Midland basins of the Permian, and terminate at Corpus Christi, Texas. It will move y-grade natural gas liquids, a mixture of natural gas plant liquids (NGPL) that requires further processing (fractionation) to become marketable products.

Graphic courtesy of EIA

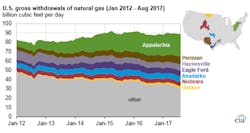

Appalachia region drives growth in US natural gas production since 2012

Shale gas production in the Appalachia region has increased rapidly since 2012, driving an overall increase in U.S. natural gas production. According to EIA’s Drilling Productivity Report, natural gas production in the Appalachia region—namely the Marcellus and Utica shale plays—increased by more than 14 billion cubic feet per day (Bcf/d) since 2012. Overall Appalachian natural gas production grew from 7.8 Bcf/d in 2012 to 22.1 Bcf/d in 2016 and was 23.8 Bcf/d in 2017, based on EIA data through October 2017. Drilling in the Marcellus Shale began in 2003 in Pennsylvania and was followed by drilling in West Virginia. In 2010 drilling began in the deeper Utica and Point Pleasant formations in Ohio and has more recently started in Pennsylvania and West Virginia. As of November 2017, more than 1,800 wells have been drilled in the Utica-Point Pleasant, and more than 11,300 wells have been drilled in the Marcellus.

Monthly Midwest crude oil imports surpass Gulf Coast’s

In August, monthly U.S. imports of crude oil coming into the Midwest (Petroleum Administrative Defense District (PADD) 2) exceeded imports of crude oil into the Gulf Coast (PADD 3) for the first time since the U.S. Energy Information Administration began keeping records in 1981. Although Hurricane Harvey disrupting Gulf Coast port operations and temporarily limiting imports was a primary factor in this reversal, which continued in September, other long-term trends contributed as well. Specifically, imports of crude oil into the Gulf Coast have been decreasing over the past 10 years, and imports into the Midwest have been increasing over the same period. These long-term trends narrowed the difference in imports between the two regions and contributed to the reversal in the historical relationship after Hurricane Harvey.

Graphic courtesy of EIA

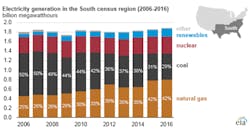

Natural gas power generation share grew in US southern states

Coal’s share of total electricity generation in the U.S. South declined over the past decade, from 50 percent in 2006 to 29 percent in 2016. As the use of coal has declined, the use of natural gas has increased. In 2016, southern states used natural gas for 42 percent of their electricity generation, a bigger share than the U.S. average of 34 percent. The mix of fuels used to generate electricity varies among southern states, but the overall mix is dominated by natural gas and coal. At the state level, natural gas made up as much as 89 percent of in-state electricity generation in Delaware to as little as 2 percent in West Virginia. Wind additions in the South have been concentrated in Texas and Oklahoma, which ranked first and third nationally for total installed wind capacity as of September 2017. Texas and Oklahoma are in a region with some of the country’s best wind resources. The South is home to both the newest nuclear power generator (Watts Bar Unit 2 in Tennessee) and the only new nuclear plant still under construction (the Vogtle plant in Georgia). Earlier this year, construction of the V.C. Summer nuclear power plant in South Carolina was canceled.

EIA forecasts a mostly balanced oil market in 2018

The U.S. Energy Information Administration’s (EIA) December Short-Term Energy Outlook (STEO) expects global liquid fuels demand to increase in 2018, but not keep pace with supply growth, resulting in global liquids inventories increasing modestly in 2018. STEO forecasts increasing global liquid fuels inventories by an average of 50,000 barrels per day (b/d) in 2018, a downward revision from a 290,000 b/d inventory increase forecast in the November STEO. The change in STEO is driven by upward historical revisions to Chinese consumption and downward revisions to forecast production from countries within the Organization of the Petroleum Exporting Countries (OPEC).

Graphic courtesy of EIA

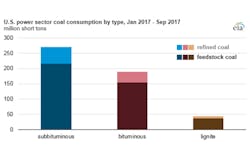

Refined coal comprises one-fifth of coal-fired power generation in 2017

The U.S. power sector consumption of coal is increasingly shifting to refined coal, even as coal-fired electricity generation decreases. Use of refined coal has increased from 17 percent of power sector coal consumption in 2016 to 19 percent so far in 2017, based on data through September. Refined coal has been processed to remove certain pollutants from raw, or feedstock, coal. Electricity generators fueled by refined coal can produce fewer emissions than those fueled by feedstock coal alone. To qualify for the refined coal tax credit, producers must have a qualified professional engineer demonstrate that burning the refined coal results in a 20 percent emissions reduction of nitrogen oxide and a 40 percent emissions reduction of either sulfur dioxide or mercury compared with the emissions that would result from burning feedstock coal. The producer must demonstrate the achievable emissions reductions every six months to continue using the tax credit, and they can only qualify for the tax for the first 10 years the processing facility is in service. Any facilities currently claiming the refined coal tax credit must have been in service by December 2011.

Graphic courtesy of EIA

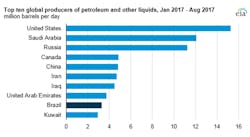

Production from offshore pre-salt oil deposits increase Brazil’s oil production

Brazil produced 3.3 million barrels per day (b/d) of petroleum and other liquids so far in 2017, according to data through August, up from 3.2 million b/d in 2016, making it the ninth-largest producer of petroleum and other liquids in the world. Production of crude oil in Brazil increased in recent years as producers targeted large, offshore, pre-salt oil deposits. Brazil’s pre-salt oil production in 2016 reached a record 1.02 million b/d, surpassing the 2015 production level by 33 percent. Using a floating production, storage, and offloading vessel (FPSO), early production from Libra has been about 50,000 b/d. Development of the field is expected to continue in the 2020s with the deployment of another FPSO that has a production capacity of 150,000 b/d. ANP estimates that peak production at Libra could eventually reach 1.4 million b/d.