Low–Voltage VFD Market Poised for Growth in 2014

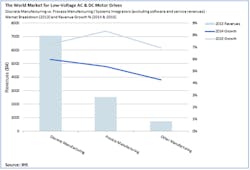

After two years of stagnation, the low-voltage (LV) VFD market is expected to grow in 2014, according to analytics firm IHS. Since 2011, revenues for VFDs (variable-frequency drives) have maintained flat growth (0.3 percent CAGR from 2011 to 2013), as European countries have been cautious to invest and export demand from Asia Pacific has provided minimal incentives to invest. By contrast, unit shipments have increased slightly over the same time frame (2.6 percent CAGR), as lower-priced VFD sales have accelerated marginally during this same period. Although market revenues did not significantly increase in 2013, early indications for 2014 suggest that investment sentiment has improved and is expected to lead to accelerated growth in upcoming years.

“After several years of a repressed economic environment, Europe’s process markets will recover towards the end of 2014,” IHS analyst Kevin Schiller said in a prepared statement. “In addition, the upcoming Energy-related Products Directive deadline in 2015 will spur additional growth in the European variable frequency drives market.”

RELATED: Redefining Pump Control—The secret to minimizing your maintenance requirements

As process markets improve in Europe, growth will recover in VFD markets, which will in turn lead to a recovery in premium drives sales. With the exception of Japan, economic activity is expected to accelerate for all major countries through 2016. IHS projects that gradual increases in global economic activity will pick up, to 2.9 percent in 2014 and 3.5 percent in 2015.

One factor that indicates high potential for LV drives is the increasing of inventories by machine builder sectors. While revenues allocated to discrete sectors have grown recently, process market revenues have remained subdued. The success of discrete sectors influences the compact and standard drives market more so than the premium drives market because of their concentration within those sectors. While approximately 70 percent of compact and standard drive revenues are from machine-building sectors, these sectors only account for approximately half of premium drive revenues. As compact and standard drives have a lower average selling price (ASP) than premium drives, this helps to explain the recent dichotomy between unit shipment growth and revenue growth, IHS says.

Since the 2009 global market contraction, machine builders, distributors, and system integrators have become more cautious about their level of stock of machinery. However, recent reports from suppliers have noted that sales to these customers have grown more quickly than process markets. Although end-user sectors have lagged behind in growth, investment sentiment has improved as customers become less wary of another market contraction.

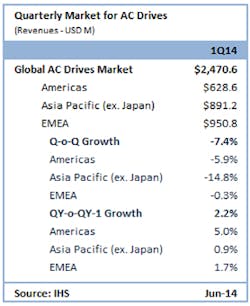

Quarterly sales data verify expectations for increased market potential. While quarterly growth contracted in the first quarter of 2014 (as predicted), the market is stronger than it was in the first quarter of 2013 in every region included in the IHS Quarterly AC Drives Tracker. Globally, the market in the first quarter of 2014 is more than 2 percent higher than it was in the first quarter of 2013. As a stronger recovery in EMEA is not expected until later in 2014, this early growth has reinforced anecdotal evidence that discrete markets are preparing for expected increased demand.