Market Updates: Projected growth in process instrumentation and automation industry; global flowmeter market

MCAA market forecast projects PI&A industry to be $17B by 2023

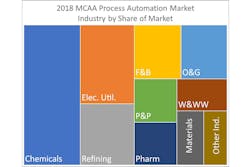

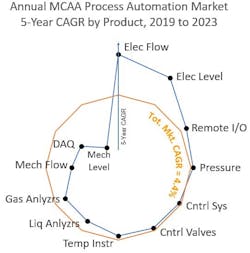

The Measurement, Control & Automation Association (MCAA) published its Annual Market Forecast. The report, prepared by the analysts at Global Automation Research LLC, focuses on the Process Instrumentation and Automation (PI&A) markets in the U.S. and Canada. Twelve industry segments and 12 product categories are examined in-depth, with a forecast timeline extending to the year 2023. The Process Instrumentation and Automation market in the U.S., valued at $13.9 billion, is projected to grow 4.4% by 2023 to a total of $17.3 billion.

Three industries accounted for over 50% of the 2018 total process automation market: chemicals, oil refining and electric utilities. These three industries, plus food and beverage, and pharmaceuticals will be the fastest growing segments over the five-year forecast period.

"There are strong growth drivers in each of these industries including the build-out in ethylene plants, capacity expansions in oil refineries, new natural gas-fired generators, and the growing drive for automation to improve productivity, enhance quality and safety, and extent plant life in the pharmaceutical and food and beverage sectors," said Paul Rasmusson, president of Global Automation Research LLC.

The report shows that O&G process automation spending recovered strongly in 2018, with most of the growth in the midstream segment.

Process control systems and process control valves continue to dominate the market value, accounting for 60% of the total for 2018. The fastest growing product categories are electronic flow, electronic level and remote I/O. The report shows that the displacement of some older technologies (e.g., mechanical flowmeters, mechanical level meters and data acquisition instruments) continue as electronic flow and level meters and expanded DCS, PLC and SCADA capabilities are adopted by the process industry.

Courtesy of MCAA

The Market Forecast also includes information for the Canadian Process Automation Market, which is valued at $1.3 billion and forecast to grow to $1.5 billion by 2023, a five-year CAGR of 3.4 percent. Five industries — food and beverage, chemicals, pharmaceuticals, oil refining and electric utilities will grow above average.

Flow Research predicts global flowmeter market to approach $8.85B by 2023

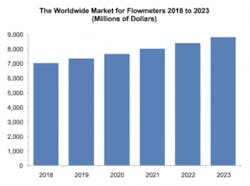

A new study from Flow Research, “Volume X: The World Market for Flowmeters, 7th Edition,” finds that the worldwide flowmeter market totaled $7.06 billion in 2018 and is projected to approach $8.85 billion by 2023.

While new technology flowmeters are displacing traditional technology meters in some applications, traditional meters are still a major force in the flowmeter market. New technology flowmeters — meters first introduced after 1950 — include Coriolis, magnetic, ultrasonic, vortex and thermal flowmeters. Traditional technology flowmeters include differential pressure (DP), positive displacement, turbine, open channel and variable area flowmeters.

Courtesy of Flow Research

Coriolis and ultrasonic flowmeters, which are industry-approved for custody transfer of both gas and liquids, are projected to experience the fastest growth rates over the next four years.

In addition to growth factors related to the oil and gas industry, product improvements in both new and traditional technology flowmeters are contributing to the upward trend in the worldwide market. Some product improvements include modern materials for meter parts or liners, additional line sizes, increased accuracy and broader flow ranges. Suppliers are also making battery-powered units, smaller meter bodies for tight spaces, multivariable meters and self-monitoring or self-recalibrating meters.

Regulatory reporting requirements and the need for continuous measurement without interruption are increasing the value of redundancy in measurement. Vortex and turbine suppliers have brought out flowmeters with two sensors and dual flowmeters calibrated together. New differential pressure flowmeters offer fully integrated orifice plates with multiple transmitters. Dual turbine rotor designs offer greater turndown flow range along with enhanced accuracy. Redundancy is rapidly taking its place along with accuracy and reliability as key features of a flowmeter.