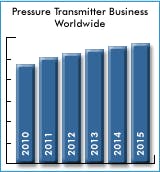

Pressure Transmitters Market Rebounds from Global Recession

ARC says pressure transmitter suppliers have benefited from renewed investment and expansion activities, and they have aligned their business goals to capitalize on growing industry segments and geographic regions that will enable them to increase market share. “Oil prices are on the rise again with the economic recovery, increased demand, and political and social unrest in the Arab world,” says Analyst Allen Avery, principal author of ARC’s “Pressure Transmitter Worldwide Market Outlook Study,” in a prepared statement. “This should continue to drive demand for pressure transmitters going forward, as higher prices favor increased exploration, production, and processing of fossil fuels.”

According to ARC, pressure transmitters have evolved into highly capable and reliable process instruments, offering users better measurement accuracy, increased visibility into their production operations, and diagnostic tools to help detect problems with both plant equipment and processes. While ARC says the installed base of transmitters probably still works well, it believes the question users should ask themselves is whether or not these devices, which may lack intelligence or the ability to take measurements within ever-tightening tolerances, are suitable for a business environment that demands more efficiency, reliability, and safety than ever before.

A new emphasis on safety is also expected to drive adoption of Safety Instrumented Systems and SIL-rated transmitters, which carry a much higher price tag than conventional, non-rated models. As such, ARC says plant owner-operators have begun to take the reliability and longevity of their key assets very seriously, and can be expected to implement plant asset management systems and smart instrumentation. Sales of wireless transmitters have increased substantially in recent years as well, and ARC expects that adoption rates for wireless will continue to be healthy in the future, particularly once wireless standards coalesce.

Regionally, ARC says suppliers can expect to see the largest growth in the Middle East due to its high concentration of oil and gas activities, and in Asia, where heavy investment in new plant construction continues in core sectors. In the mature North American and Western European markets, suppliers will largely rely on replacement business. Latin America will see above average growth, but remain a relatively small market for pressure transmitter suppliers, according to ARC.

For more information on the “Pressure Transmitter Worldwide Market Outlook Study” study, click here.