Cement Plants to Spend $2.6 Billion Per Year for Air Pollution Control

New hazardous air-pollution rules for U.S. cement plants will boost the market for air pollution control in the United States, as will infrastructure growth in the developing world, according to market analysis by McIlvaine Company.

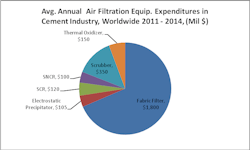

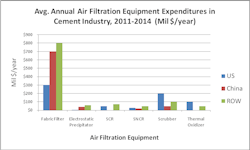

Despite the boost from the new U.S. rules, McIlvaine says the U.S. market will be smaller than the Chinese market through 2014. The United States will lead in purchases of scrubbers and thermal oxidizers, but fabric filters will be the largest equipment category.

The cement plants around the world are increasingly utilizing fabric filters for cleaning the gas from the kilns. Formerly electrostatic precipitators were used for this application. For many years, fabric filters have been used for coal grinding and material transfer points. McIlvaine says large cement plant suppliers are frequently furnishing fabric filters as an integral part of new plants they are building, regardless of whether they are in a developed or a developing country.

SO2 is of increasing concern in the United States and Europe, and, as a result, McIlvaine says wet limestone scrubbers will be a popular choice in the United States. For Cement MACT rule Relative to NOx control, selective non-catalytic reduction is expected to be the most popular choice. However, the equipment cost is low. The big cost is in the area or ammonia injection.

There is also expected to be a significant market for activated carbon in the U.S. The EPA expects most U.S. plants to install activated carbon injection systems to remove mercury. This could result in boosting total activated carbon sales in the U.S. by 5 to 10 percent, according to McIlvaine.

Kerogen (organic chemical compounds) in the limestone calcined to make cement is vaporized and, as result, forms toxic organic air pollutants. The EPA expects many plants to install thermal oxidizers to destroy these emissions. However, McIlvaine says it is also likely that some plants will be able to make sufficient reductions using activated carbon injection. Nevertheless, McIlvaine predicts the U.S. market for thermal oxidizers for this application will average $100 million/yr.