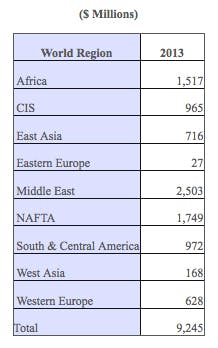

Sales of valves to the oil and gas industry are expected to be $9.2 billion next year, according to the latest forecasts by the McIlvaine Company.

The Industrial Valves: World Markets report shows the Middle East will generate the most revenue in valve sales, but the market in the United States, Canada, and Mexico is closing the gap, where large numbers of valves are required in hydraulic fracturing. In the U.S., there is a very large investment in extraction of liquids from the wet shale in the West and gas from dry shale areas in Texas and Pennsylvania.

The valve market is also expanding due to the expenditures to liquefy natural gas. In the U.S., terminals that were built to import and gasify LNG are now being converted over to liquefy the U.S. shale gas and export it.

McIlvaine says new regulations on fugitive emissions also impact the valve market. Systems to capture gas now released during well completion incorporate a number of valves. The reclamation and reuse of wastewater is also an expanding application for valves.

McIlvaine says sub-sea applications challenge valve suppliers with requirements for high pressure and performance. The corrosive nature of flow-back fluids in hydraulic fracturing, present a challenge in materials selection.

The transport of gas liquids, which are a byproduct of shale gas extraction, provide still another valve application. There are also plans to invest more than $20 billion in gas-to-liquid plants. These plants will take advantage of the disparity between natural gas and oil prices and each plant will require thousands of valves, McIlvaine says.

For more information on Industrial Valves: World Markets, click here.