Expanding energy industry powers growth in ultrasonic flowmeter market

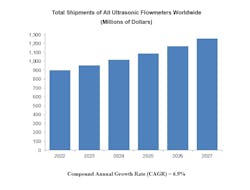

Wakefield, Massachusetts; January 4, 2024 (Flow Research release) — A new research study from Flow Research, The World Market for Ultrasonic Flowmeters, 7th Edition (www.flowultrasonic.com), finds that the ultrasonic flowmeter market continues to expand, powered by dynamic growth in the energy industry. The study found that the worldwide ultrasonic market totaled $900 million in 2022 and forecasts that revenues will grow at a 6.9 percent compound annual growth rate (CAGR) to reach a worldwide total of $1.26 billion by 2027. In a few decades, ultrasonic meters have gone from being mistrusted to being the fastest-growing flowmeter technology in the world.

The oil & gas industry is by far the largest consumer of ultrasonic flowmeters, and is responsible for much of the meter’s growth rate. Flow research found that the industry, including refining, accounted for more than 60 percent of revenues worldwide for inline ultrasonic flowmeters in 2022. Upstream applications make up a significant portion of these revenues, although midstream and downstream applications are also significant.

Oil prices on the rise

The role of ultrasonic flowmeters in the oil & gas industry is heavily dependent on oil prices. In 2020, the COVID-19 pandemic severely depressed the price of crude oil. In 2021, oil prices were still affected by the pandemic, but were on the increase throughout the year. Prices mostly ranged between $50 and $80 per barrel in 202l. The oil market was much stronger in 2022, and prices varied between $80 and $100 per barrel for much of the year. West Texas Intermediate (WTI) crude oil prices even climbed above $100 per barrel in March 2022, and stayed on either side of $100 per barrel through the end of July. The peak was on March 8, 2022, when WTI closed at $123.64 per barrel.

While 2023 was not as strong a year as 2022, oil prices remained north of $70 and $80 for much of the year. The effect of pent-up demand, which began in 2022, kept demand for refined petroleum products high. Despite growth in inflation and the effects of two wars, the oil markets remained strong and stayed in recovery and growth mode throughout 2023. This period of growth in oil production has been very favorable to the flowmeter market, especially to ultrasonic, Coriolis, turbine, differential pressure, and positive displacement flowmeters.

New frontiers of energy research

Ultrasonic suppliers are exploring ways to tackle issues that come with measuring oil and gas. These include measuring wet gas and overcoming the effects of contamination, flow disturbances from blockages in the line and build-up inside the pipe, lack of adequate straight run, and problems with costly false alarms. Many ultrasonic meters now incorporate innovative path arrangements, self-verification, enhanced diagnostics, and other features to provide greater accuracy as well as a clearer and more timely view of what’s happening with meters in the field.

Ultrasonic meters are playing a major role as the world transitions away from reliance on fossil fuels and towards cleaner forms of energy. They are eyeing entrance into the renewable energy market, which includes measuring biogas, synthetic fuels, and hydrogen derived from renewable natural gas (RNG) and synthetic fuels. Hydrogen’s physical properties are quite different from other gases, including natural gas, and flowmeter suppliers have had to adapt to those differences, as well as figure out ways for ultrasonic meters to accurately measure hydrogen blends. Some ultrasonic flowmeter manufacturers now offer meters that measure hydrogen and are continuing to explore how to best measure hydrogen and hydrogen blends.

Advantages of ultrasonic flowmeters

Ultrasonic flowmeters offer many benefits: high flow measurement accuracy, high reliability, high turndown ratios, competitive pricing, no moving parts, low maintenance, valuable diagnostics, bi-directional flow measurement, and redundancy capabilities.

Ultrasonic flowmeters are also one of the few types of flowmeters with sufficient size and accuracy to economically accommodate the larger diameters of oil and natural gas pipelines, which can run from 20 to 42 inches and more. Although the industry tends to be conservative, many end-users are replacing conventional turbine and differential pressure (DP) flowmeters, which are often used in upstream and midstream operations, with inline ultrasonic flowmeters. Unlike turbine meters, ultrasonic meters have no rotors or other moving parts that can be dislodged by particles. They also do not suffer from the pressure drop that is inherent in differential pressure flowmeters. In competitive new-technology meters, Coriolis meters are slightly more accurate than ultrasonic flowmeters, but they only support pipe sizes up to 16 inches and are both heavy and extremely expensive in that range.

Coriolis meters are also better suited for measuring liquids than gas, which gives ultrasonic meters an advantage. In fact, probably the single most important factor in the recent growth of ultrasonic flowmeters in the past 15 years has been the rapid growth in the market for inline multipath ultrasonic meters for custody transfer of natural gas.

Performance varies by mounting type

The ultrasonic market is divided into three mounting types: inline (spoolpiece), clamp-on, and insertion. The performance and applications of ultrasonic meters vary by these different types.

Inline flowmeters best fit the criteria for custody transfer applications. They have three or more paths and are capable of high accuracy. Inline meters are mounted by cutting the pipe, and have a meter body that is mounted inline with the pipe. Ultrasonic transducers that send a signal across the pipe are mounted on the meter body. Ultrasonic meters measure the difference between the time it takes for the signal to travel across the pipe when traveling with the flow and against the flow, and use this difference to compute flowrate. Multipath inline meters can have from three to as many as 18 different paths. Much of the high accuracy and diagnostic capabilities of inline meters come from these multiple paths, together with advanced software.

Clamp-on ultrasonic meters were first introduced in Japan in 1963 by Tokyo Keiki. Badger Meter brought them to the United States in 1971 through a private label arrangement. Controlotron, acquired by Siemens in 2006, popularized clamp-on ultrasonic meters in the United States beginning in 1972. Clamp-on meters have some important advantages. Their transducers are strapped onto the outside of a pipe, meaning they don’t interact at all with the fluid being measured. They are also highly portable (though some are fixed), meaning they can be moved from one pipe measurement to another. This makes them ideal for check-metering applications. One disadvantage of clamp-on meters is that the pipe wall can attenuate the signal, causing a less accurate measurement. Due to this and other factors, clamp-on meters cannot achieve the same level of accuracy as most inline meters.

Insertion meters have transducers that are inserted into an existing pipe. This gives them an advantage over inline meters, since they eliminate the cost of a meter body. Insertion meters are widely used for flare and stack gas measurement. They provide an economical way to measure flow in large pipes, especially ones where an inline meter would be impractical. Their lower cost and ease of installation add to their versatility. Insertion ultrasonic meters are important at a time when end-users and regulatory bodies are paying more attention than ever to carbon dioxide emissions.

According to Dr. Jesse Yoder, president of Flow Research:

“Ultrasonic flowmeters will play a pivotal role in flow measurement as the world transitions away from fossil fuels. Not only can they easily and accurately measure the flow of refined fuels and natural gas, but they are also in the vanguard when it comes to measuring hydrogen and natural gas with hydrogen blends. Natural gas remains a more environmentally friendly source of energy than coal and oil. Despite the attractiveness of renewable energy, it will take years to replace oil and natural gas, given the world’s growing need for energy. Whatever energy sources are chosen, ultrasonic flowmeters will be there to meet the measurement need.”

The World Market for Ultrasonic Flowmeters, 7th Edition includes a Core study and two standalone modules: Module A: The World Market for Inline Ultrasonic Flowmeters and Module B: The World Market for Clamp-on and Insertion Ultrasonic Flowmeters. The studies provide analysis, company profiles, detailed market size worldwide and by region, market shares, and forecasts for ultrasonic flowmeters worldwide through 2027.

About Flow Research

Flow Research (www.flowresearch.com) is the only independent market research company whose primary mission is to research flowmeter and other instrumentation products and markets worldwide. Flow Research, founded in 1998 in Wakefield, Massachusetts, specializes in flow measurement devices, and conducts market research studies in a wide variety of instrumentation areas. These studies are developed through interviews with suppliers, distributors, and end-users, including multiple on-site visits. Topics include all the flowmeter technologies – both new and conventional – as well as temperature sensors, temperature transmitters, level products, and pressure transmitters. The company has a special focus on the energy industries, especially on oil and gas production and measurement.

Dr. Jesse Yoder, founder and president of Flow Research, has written more than 300 articles on flowmeters and other instrumentation for technical publications and has authored four books, including a two-volume set, Advances in Flowmeter Technology, published by CRC Press in 2022 and covering New-Technology Flowmeters and Conventional Flowmeters.

For more information, visit https://www.flowresearch.com or call +1 781-245-3200.